Major changes to how the Energy Efficiency (Private Rented Property) (England and Wales) Regulations 2015 (the “MEES Regulations”) affect commercial property are coming into effect on 1 April 2023.

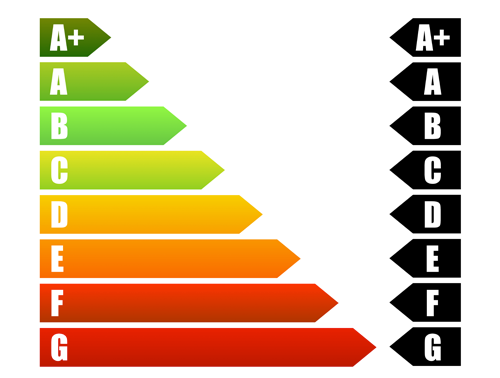

On 1 April 2018, it became unlawful to grant a new commercial lease of a ‘sub-standard’ property with an EPC rating of less than E without a permitted exemption.

From 1 April 2023, it will also become unlawful to continue to let any commercial property with an EPC rating of F or G, (i.e. where the lease was granted prior to 1 April 2018), without a permitted exemption.

As a commercial landlord, you need to take action immediately to stay compliant with the MEES Regulations.

What is MEES?

Minimum Energy Efficiency Standards (MEES) are regulations which require a minimum energy efficiency standard to be met before properties in England and Wales can be let or sold.

What properties do MEES apply to?

MEES regulations apply to both domestic and non-domestic properties in England and Wales which are legally required to have an energy performance certificate (EPC). There are certain exemptions (such as places of worship or temporary buildings with an expected lifespan of less than 2 years) but these are limited.

The questions in this blog focus on the impact of the MEES Regulations for commercial property.

Do the MEES Regulations apply to my property?

The MEES Regulations only apply to properties required to have an EPC rating. There are certain properties, such as listed buildings (where compliance with minimum energy performance requirements would unacceptably alter their character or appearance), which may not require an EPC. However, the provisions as to whether an EPC is required or not are complex, and we suggest obtaining legal advice to avoid falling foul of the MEES Regulations.

Short leases of less than six months (with no right of renewal) and long leases of over 99 years are excluded from the MEES Regulations so there is no need to provide an EPC to the tenant.

Who is responsible for complying with MEES?

Landlords (and superior landlords) are the only party that can be sanctioned under the regulations so compliance firmly sits with them. Having said that, MEES are also undoubtedly an issue for occupiers. Dependant on the terms of a particular lease, MEES may affect decisions about alterations/fit-out, service charge, lease renewal negotiations and dilapidations.

What are the key changes to the law from 1 April 2023?

Landlords cannot continue to rent a property with an EPC rating of F or G. Despite it being unlawful, the lease is still valid and enforceable and the landlord and tenant must continue to comply with their respective covenants in the lease, including payment of rent, service charge and other sums due.

Where the MEES Regulations apply, landlords must hold a valid EPC at all times to demonstrate that a property has the requisite EPC rating of E or higher. Previously, where an EPC expired during the term of the lease, there was no obligation to obtain a new one.

Tenants that are leasing sub-standard property must continue to pay all rents, service charge and other payments, and it will not be possible to terminate the lease on grounds of non-compliance with the MEES Regulations. Likewise, the landlord cannot require the tenant to vacate the property.

What are the penalties for non-compliance?

Where a commercial landlord continues to rent a sub-standard property a penalty notice could be served with fines issued up to £150,000. The size of the fine will depend on the rateable value of the property and the length of the breach of MEES.

What are my options?

Review your property portfolio in line with the government guidance for landlords. For any properties with EPC ratings of less than E, consider whether you can apply for an exemption. A temporary six-month exemption may apply when a person suddenly becomes the landlord of a property with an EPC rating of below E. Additionally, the following key exemptions apply to commercial property and last for five years:

- Seven-year payback: where a landlord can show that the cost of implementing a recommended improvement is greater than the expected energy bills savings over seven years.

- All improvements made: where all the recommended energy efficiency improvements have been made to the property but the EPC remains below E.

- Consent: where implementing a recommendation requires the landlord to first get consent from a third party, such as the local authority or superior landlord.

- Devaluation exemption: where an independent chartered surveyor advises that the installation of specific energy efficiency measures would reduce the market value of the property by more than 5%.

Note any of the above exemptions must be registered on the PRS Exemptions Register by the landlord and will only be valid from the point of registration. Exemptions cannot be transferred to a new owner or landlord.

If an exemption doesn’t apply, you will need to carry out energy improvement works to attain an EPC rating of at least E. Your EPC report will list recommendations for improving the energy efficiency of your property. When carrying out improvements, you will need to liaise with tenants and comply with any consent requirements and service charge recovery provisions in the lease.

What does the future hold?

It seems extremely likely that future changes will include more stringent rules on minimum energy efficiency.

Our commercial property experts are on hand to deal with any questions you might have about the upcoming changes and the impact of the MEES Regulations on existing leases, new leases and the sale of commercial property.